Project Description

This project examines how historical stock markets developed and how these developments influenced firms and investors. The focus is on understanding how companies gained access to capital, why they decided to list on an exchange, and how investors reacted to changing market conditions. The analysis draws on historical records and long-run financial data to trace how market structures, rules and institutions shaped financing opportunities and investment behaviour.

By studying different periods of market growth, decline and reorganisation, the project aims to show how stock markets contributed to economic activity and how firms and investors adapted to opportunities and constraints in their financial environment. The goal is to provide a clearer picture of the relationship between market organisation, corporate finance and investor decisions in the past.

Research Grants

Expectations and experience: What governed investment in banking stocks (1897 - 1931). Funded by DFG as part of the Priority programme (SPP 1859): Experience and Expectation: Historical Foundation of Economic Behaviour.

Involved Researchers

Sibylle Lehmann-Hasemeyer (sibylle.lehmann@uni-hohenheim.de)

Alexander Opitz (former staff)

Project-related Publications

Lehmann-Hasemeyer, S., Dwenger, N. and O. Ehrhardt (2025). IPOs in the Long Run: Institutional Change, Stock Market Consolidation and Firm Financing in Germany, 1897–2016 . mimeo (currently under review)

Lehmann-Hasemeyer, S. and Opitz, A. (2024). Data Sources on the 19th and Early 20th Century German Capital Market: Challenges and Opportunities. German Economic Review. https://doi.org/10.1515/ger-2024-0067

Lehmann-Hasemeyer, S. and Neumayer, A. (2022). The limits of control: corporate ownership and control of German joint-stock firms, 1869–1945. in Financial History Review, 29 (2), 152 – 197

Lehmann-Hasemeyer, S. and Streb. J (2021). Finanzierung von Innovationen durch die deutschen Börsen von 1896 bis 1932. In Zeitschrift für das gesamte Kreditwesen. (74), 36- 41.

Lehmann-Hasemeyer, S. and Neumayer, A. (2019): Does the preference for investment in local firms rise in turbulent times? Evidence from the portfolio of Joseph Frisch, private banker (1923–55). Journal of Business History/Zeitschrift für Unternehmensgeschichte, 64(1), 1-18.

Lehmann-Hasemeyer, S. and Opitz, Alexander (2018). The value of active politicians on supervisory boards-Evidence from the Berlin stock exchange and the parliament in Interwar Germany. Scandinavian Economic History Review, forthcoming

Burhop, C. and S. Lehmann-Hasemeyer (Hg.) (2018). Börsengeschichte / Stock Market History. Jahrbuch für Wirtschaftsgeschichte 59(1), forthcoming.

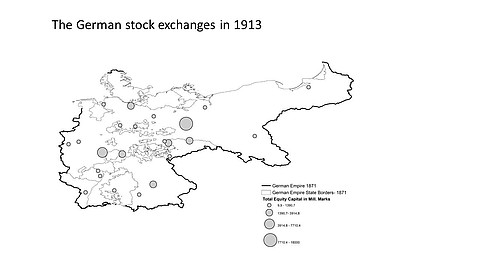

Burhop, C. and Lehmann-Hasemeyer, S. (2016). The Berlin stock exchange and the geography of German stock markets in 1913. European Review of Economic History, 20(4), 429-451.

Lehmann-Hasemeyer, S. and Streb, J. (2016). The Berlin Stock Exchange in Imperial Germany – a Market for New Technology? American Economic Review, 106(11), 3558–3576.

Lehmann-Hasemeyer, S. and Burhop, C. (2014). The Geographic Conversion of German Stock Exchange Centres, 1913-37. Bankhistorisches Archiv, 40 (1-2), 23-37.

Lehmann-Hasemeyer, S., Hauber, P., Opitz, A. (2014). The political stock market in the German Kaiserreich - Do markets punish the extension of the suffrage to the benefit of the working class? Evidence from Saxony. Journal of Economic History, 74(4), 1140-1167.

Lehmann S. (2014). Taking Firms to the Stock Market: IPOs and the Importance of Large Banks in Imperial Germany 1896-1913. Economic History Review, 67(1), 92–122.

Lehmann S. (2011). Die Bedeutung der Emissionsbanken auf dem deutschen Aktienmarkt 1896-1913. Vierteljahresschrift für Sozial- und Wirtschaftsgeschichte, 98(3), 331-340.