Project Description

The central purpose of the project is to investigate how expectations of economic actors are formed. It aims at studying expectations and investment decisions on the different stock exchanges in the period 1897 to 1931. Investment decisions on stock markets are particularly interesting since here one observes types of investment behavior, which finance models failed to predict so far. For instance, it can be shown that investors take high idiosyncratic risk, under-diversify their portfolios or gamble with stocks, which is possibly driven by overconfidence and herding behavior. Moreover, previous research has shown that socioeconomic characteristics of individual investors influence their expectations and investment decisions. In order to improve the interpretation of stock market behavior of investors it is necessary to learn more about how their characteristics changed and influenced their behavior. So far there is little information about individual investors and there are no analyses of investor characteristics in this period. Therefore, a central task of this project is to reveal typical characteristics of investors.

In future, it is planned to study individual savings decisions based on information of individual savings books, household books, diaries and other available archival material for the period 1870 to 1970. Overall, one can see that socioeconomic characteristics of individuals strongly influence the expectations and therefore not only the investment behavior but also the saving behavior. In a first step, we aim at learning more about which characteristics mattered most and how this changed over time.

Research Grants

2019-2021 “Individual Experience and saving behavior”. The project is funded by the German Research Foundation (DFG) with 300.980 Euro.

2015-2018 “Expectations and experience: What governed investment in banking stocks (1897-1931)”. The project was funded by the German research Foundation (DFG) with 354.027 Euro.

Involved Researchers

Sibylle Lehmann-Hasemeyer

Jochen Streb

Project-related Publications

Hesse, J.-O. , Knake, S., Lehmann-Hasemeyer, S. (2026). Saving Behavior in the Nineteenth and Twentieth Centuries, in Köhler et al. (Ed.). The Routledge Handbook of Economic Expectations in Historical Perspective. Routledge, New York, p. 408-423.

Lehmann-Hasemeyer, S. , Neumayer, A., & Streb, J. (2023). Heterogeneous inflation and deflation experiences and savings decisions during German industrialization. Journal of Banking & Finance, 154, 106978.

Lehmann-Hasemeyer, S. and Wahl, F. (2020): The German bank–growth nexus revisited: savings banks and economic growth in Prussia. Economic History Review, 74(1), 204-222.

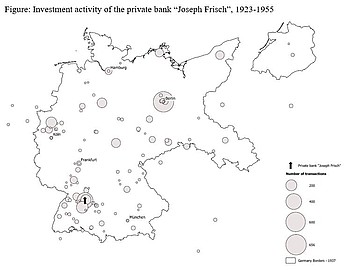

Lehmann-Hasemeyer, S. and Neumayer, A. (2019): Does the preference for investment in local firms rise in turbulent times? Evidence from the portfolio of Joseph Frisch, private banker (1923–55). Journal of Business History/Zeitschrift für Unternehmensgeschichte, 64(1), 1-18.

Lehmann-Hasemeyer, S. and Opitz, A. (2019): The value of active politicians on supervisory boards: evidence from the Berlin stock exchange and the parliament in interwar Germany. Scandinavian Economic History Review, 67(1), 71-89.

Lehmann-Hasemeyer, S. and Streb, J. (2018): Does Social Security Crowd Out Private Savings? The Case of Bismarck’s System of Social Insurance. European Review of Economic History, 22(3), 298–321.